5 Must-Have Features for an Effective B2C Invoice Generator

As a B2C (business-to-consumer) business owner, invoicing is a crucial aspect of your operations. Invoicing helps to ensure that you get paid for your products or services, maintain accurate accounting, and establish a good reputation with your customers.

However, manual invoicing can be a time-consuming and tedious task that can distract you from other important business tasks. This is where an invoice generator can come in handy. In this article, we will explore the 5 must-have features for an effective B2C invoice generator.

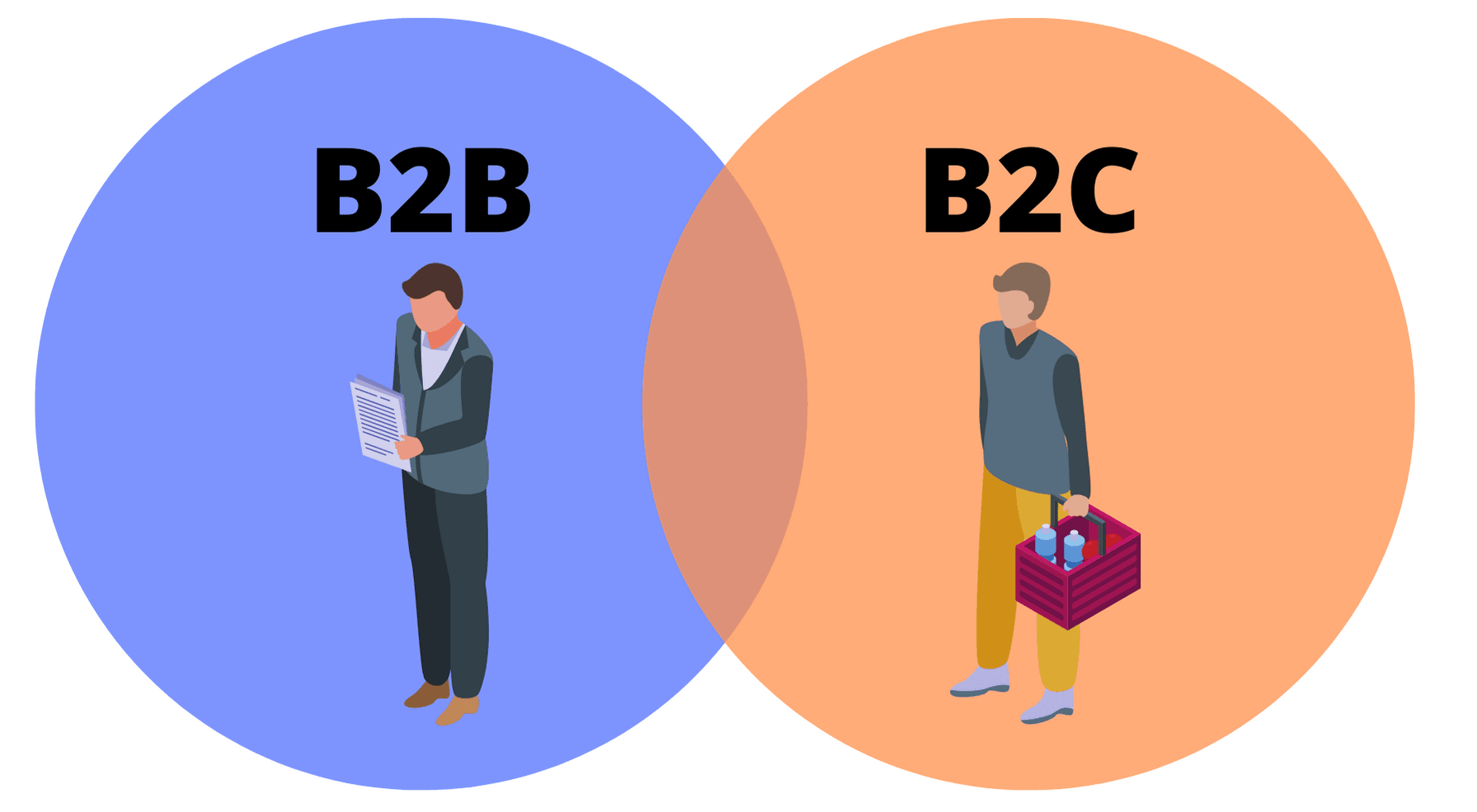

B2B and B2C

The terms B2B and B2C are commonly used in the business world to describe two different types of commercial transactions. B2B stands for "business-to-business," while B2C stands for "business-to-consumer."

While both types of transactions involve the exchange of goods or services for money, there are significant differences between them that businesses need to understand. In this article, we will explore the key differences between B2B and B2C.

Target audience

The first and most significant difference between B2B and B2C is the target audience. B2B businesses target other businesses as their customers, while B2C businesses target individual consumers.

B2B businesses tend to sell products or services that other businesses need to operate, such as raw materials, components, or software. B2C businesses, on the other hand, sell products or services that consumers need or want for personal use, such as clothing, food, or entertainment.

Sales cycle

Another significant difference between B2B and B2C is the sales cycle. B2B transactions tend to have longer sales cycles, as they often involve larger volumes and more complex purchasing decisions.

B2B buyers may need to consult with multiple stakeholders within their organization before making a purchase, and the decision-making process can take weeks or months. B2C transactions, on the other hand, tend to have shorter sales cycles, as they often involve impulse purchases or quick decisions based on personal preferences.

Marketing strategies

The marketing strategies used by B2B and B2C businesses also differ significantly. B2B businesses tend to focus on building long-term relationships with their customers, as their transactions often involve repeat business and ongoing contracts.

B2B businesses may use account-based marketing, targeted email campaigns, or industry events to reach their target audience. B2C businesses, on the other hand, tend to focus on creating brand awareness and driving customer engagement through social media, content marketing, and advertising.

Pricing and payment terms

Pricing and payment terms can also differ significantly between B2B and B2C transactions. B2B businesses may negotiate pricing and payment terms with their customers based on the volume of the transaction, the length of the contract, or other factors.

B2B businesses may also offer discounts or incentives to encourage long-term relationships with their customers. B2C businesses, on the other hand, tend to offer fixed pricing and payment terms, with occasional discounts or promotions to drive sales.

Customer service

Finally, the customer service provided by B2B and B2C businesses can also differ significantly. B2B businesses may provide more personalized customer service, as their transactions often involve larger volumes and longer-term relationships.

B2B businesses may assign dedicated account managers or customer service representatives to their clients to ensure that their needs are met. B2C businesses, on the other hand, may focus on providing efficient customer service through online channels, such as chatbots or email support.

B2B and B2C transactions differ significantly in terms of target audience, sales cycle, marketing strategies, pricing and payment terms, and customer service. Understanding the differences between these two types of transactions can help businesses tailor their strategies and operations to meet the unique needs of their customers.

5 Must-Have Features for an Effective B2C Invoice Generator

Customizable templates

Customizable templates are essential for an effective B2C invoice generator. They allow you to create professional-looking invoices that reflect your brand and business values.

With customizable templates, you can add your business logo, payment terms, and other essential details that align with your brand identity. This can help you stand out from the competition and build a positive image with your customers.

Easy-to-use interface

An easy-to-use interface is another critical feature of an effective B2C invoice generator. The interface should be intuitive and user-friendly, allowing you to create and send invoices quickly and easily.

The invoice generator should be able to automate data entry, calculation, and formatting, making it easy for you to create invoices with just a few clicks. This can save you time and reduce the risk of errors, allowing you to focus on other important business tasks.

Mobile accessibility

Mobile accessibility is becoming increasingly important for businesses, particularly B2C businesses. An effective invoice generator should be accessible from mobile devices, allowing you to create and send invoices on the go.

This can be especially useful for businesses with field sales teams or those that require frequent travel. With mobile accessibility, you can manage your invoicing wherever you are, ensuring that you get paid on time and maintain healthy cash flow.

Payment integration

Payment integration is another must-have feature for an effective B2C invoice generator. The invoice generator should be able to integrate with payment gateways, allowing your customers to pay their invoices online.

This can make it easier and more convenient for your customers to pay, reducing the risk of late payments or disputes. Payment integration can also help you maintain accurate accounting and record-keeping, making it easier to manage your finances and comply with regulatory requirements.

Automated reminders

Automated reminders are an essential feature of an effective B2C invoice generator. The invoice generator should be able to send automated payment reminders to your customers, reminding them of upcoming or overdue payments.

This can help you get paid faster and maintain a healthy cash flow. Automated reminders can also reduce the risk of disputes or misunderstandings, ensuring that you maintain a positive relationship with your customers.

Conclusion

Invoicing is a critical aspect of B2C business operations, and an invoice generator can help you streamline the process and improve efficiency. However, not all invoice generators are created equal.

To be effective, an invoice generator should have customizable templates, an easy-to-use interface, mobile accessibility, payment integration, and automated reminders. By choosing an invoice generator with these must-have features, you can simplify your invoicing process, get paid faster, and build a stronger relationship with your customers.