Global VAT Compliance: A Guide for Shopify Sellers

Shopify has emerged as a powerhouse for online entrepreneurs. However, as your Shopify store gains international traction, navigating the complex landscape of Global VAT (Value Added Tax) compliance becomes crucial.

Understanding and adhering to VAT regulations can significantly impact your business's success. Let Fordeer help you stay on the right side of the law and maintain a seamless international operation!

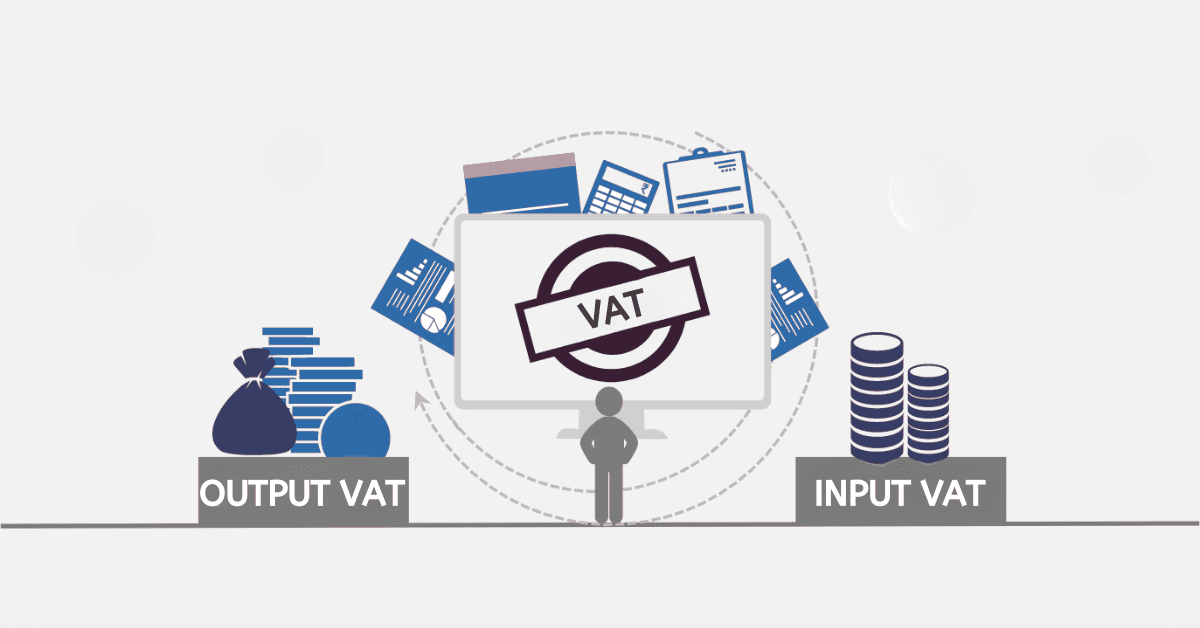

The Basics of VAT

What is VAT?

Diving into the intricacies of global compliance may seem a bit overwhelming at first to you, but let's start by getting comfortable with the basics of VAT. VAT, or Value Added Tax, is the thing that accompanies products on their journey through the supply chain.

It's a consumption tax, and here's the fascinating part: it gets added at each stage of the product's development, creating a unique trail of value. Unlike its counterpart, sales tax, VAT places the responsibility on the end consumer to bear the tax burden. This little detail is a game-changer for Shopify sellers engaging in cross-border e-commerce transactions, making it a topic we can't afford to overlook.

Why VAT Compliance matters

In managing your Shopify store, catering to a global customers brings forth the crucial responsibility of ensuring adherence to international VAT regulations. It's imperative to recognize that non-compliance not only carries the risk of hefty fines and legal consequences but also poses a potential threat to the sterling reputation of your brand.

Navigating the intricate landscape of international VAT regulations is a nuanced task, further compounded by the fact that numerous countries mandate foreign businesses to register for VAT once certain sales thresholds are attained. This additional layer of complexity underscores the importance of a comprehensive understanding of the diverse compliance requirements that emerge as your e-commerce venture reaches customers worldwide. With that, you not only safeguard your business from potential penalties but also fortify your brand's standing in the global market.

Challenges faced with VAT compliance

Complexity is inherent

Despite the theoretically shared concept of VAT, complexities arise in its practical application. Cross-border trade, involving the buying or selling of products and services across different countries, introduces a multitude of variations in VAT rates and obligations for businesses that are VAT-registered.

Each country possesses distinct VAT registration rules, rates, and exemptions, necessitating diverse segments of your data to be considered—a unique slice for each. Specific requirements for supplementary data and documentation also come into play.

Country-specific regulations dictate the format for recording VAT and the submission method. Even the rules concerning reporting dates for transactions differ, encompassing factors such as the invoice date, date of supply, or payment date. Notably, there are additional challenges posed by language and cultural differences across diverse regions.

Diverse requirements and challenges

In the global scale, there are numerous requirements that your business should take into consideration for your business to thrive. Here are some challenges you have to face with:

VAT registration rules

Navigating the intricate web of VAT registration becomes a multifaceted task as each country imposes its distinctive set of rules. This adds a layer of complexity for businesses involved in cross-border transactions, necessitating a nuanced approach to comply with diverse regulatory frameworks.

VAT rates and exemptions

The landscape of VAT rates and exemptions unveils a tapestry of variations across countries. To successfully navigate this intricate terrain, businesses must delve into a careful understanding of the specific regulations governing each jurisdiction. A keen awareness of these differences is paramount for accurate financial planning and adherence to tax obligations.

Data requirements

The diverse nature of VAT regulations extends to the realm of data requirements, where different countries may stipulate unique sets of information. This compels businesses to tailor their data according to the specific requirements of each region, emphasizing the need for adaptability in information management practices.

Supplementary data and document

In the realm of cross-border transactions, the additional data and documentation requirements imposed by various countries create a mosaic of challenges. Businesses are called upon to adapt their practices to align with the specific standards of each country, ensuring comprehensive compliance and smooth operational workflows.

VAT recording format

Navigating through the labyrinth of VAT regulations involves addressing country-specific rules pertaining to recording formats. This presents yet another challenge for businesses, requiring a high degree of flexibility to seamlessly integrate diverse recording practices into their operational framework.

Reporting dates

The complexity of VAT compliance further intensifies with divergent reporting date requirements. Variations related to the invoice date, date of supply, or payment date add an additional layer of intricacy, necessitating meticulous attention to detail and a comprehensive understanding of the unique reporting timelines in each jurisdiction.

Language and cultural challenges

Beyond the intricacies of regulatory compliance, businesses must adeptly traverse language and cultural challenges across different regions. Effectively communicating and understanding the nuances inherent in diverse cultural contexts is vital for establishing fruitful cross-border relationships and ensuring the success of international business endeavors.

VAT Compliance guide for Shopify Sellers: Tips and Tricks

VAT registration and thresholds

Mastering the intricacies of Value Added Tax (VAT) registration is a pivotal aspect of ensuring seamless global compliance for your Shopify store. The complexity of this task is underscored by the fact that each country has its own distinct set of rules, regulations, and thresholds governing VAT registration.

The multifaceted nature of international VAT regulations necessitates a keen understanding of not only the diverse thresholds but also the specific procedures and documentation requirements unique to each locale. In essence, our guide transcends the conventional by seamlessly ensuring that you not only comprehend the intricacies of VAT registration but also feel confident in navigating the regulatory landscape.

As we unravel the layers of VAT registration, our user-friendly approach aims to demystify the often daunting aspects of compliance, allowing you to navigate these procedures with finesse. Armed with the knowledge garnered from our comprehensive guide, you'll be well-equipped to steer your eCommerce venture through the complexities of global VAT regulations, fostering a compliant and thriving online business presence.

Calculation of VAT for Shopify sellers

For business-to-business (B2B) transactions

The calculation of Value Added Tax (VAT) typically centers around the net price. It's paramount to guarantee that your Shopify store is adeptly configured to showcase prices excluding VAT specifically for your wholesale clientele.

Creating a seamless experience for your wholesale customers involves fine-tuning the settings of your Shopify store to reflect the net price before VAT. This not only enhances transparency but also aligns with the standard practices in B2B transactions. The objective is to facilitate a clear and straightforward presentation of costs for wholesale buyers, fostering a more efficient and user-friendly interaction within the B2B framework.

Taking a customer-centric approach, consider implementing features that allow for easy toggling between prices with and without VAT. This not only empowers your wholesale customers to make informed decisions but also contributes to a positive and professional shopping experience. The user-friendly design of your Shopify store, coupled with a meticulous configuration catering to B2B business, reinforces your commitment to providing tailored solutions for your business clients.

By addressing the unique needs of B2B transactions and customizing your Shopify store settings accordingly, you not only enhance the functionality of your platform but also establish a rapport with wholesale customers. This thoughtful approach reflects your dedication to accommodating the specific requirements of B2B interactions, fostering trust and loyalty in your business relationships.

For business-to-customer (B2C) transactions

The inclusion of Value Added Tax (VAT) in the displayed price is a standard practice. Ensuring a seamless shopping experience for your customers, it's paramount that your Shopify store is configured to effortlessly compute and exhibit the accurate VAT-inclusive prices. This not only fosters transparency but also aligns with the expectations of consumers, contributing to a positive and trustworthy shopping environment.

Furthermore, the automatic computation and display of VAT-inclusive prices reflect your commitment to customer satisfaction and regulatory adherence. Your Shopify store not only enhances user experience but also showcases a professional and responsible approach to financial transparency. This customer-centric strategy not only instills confidence but also ensures that your business is positioned for success in an increasingly competitive eCommerce landscape.

Invoicing and documentation

Proper documentation plays a pivotal role in not only demonstrating compliance but also in facilitating seamless cross-border transactions for Shopify sellers. This section provides you with essential guidance on creating VAT-compliant invoices, ensuring they encompass all the necessary information mandated by tax authorities.

To create VAT-compliant invoices, first of all, you have to include your business name, address, and VAT identification number prominently on the invoice. By doing so, you can ensure consistency with the information provided during VAT registration.

After that, you have to include the customer’s name, address, and, if applicable, their VAT identification number. You can assign a unique invoice number and date to each transaction for easy tracking and reference.

Moreover, you have to specify the applicable VAT rates for each product or service and clearly display the VAT amount, ensuring accuracy in calculations. Plus, you ‘d better indicate the currency used for the transaction. If applicable, you can provide the exchange rate used for conversions.

Last but not least, you have to stay informed about the specific invoicing requirements in each country where you operate and comply with any additional information or formatting stipulations mandated by local tax authorities.

Managing VAT returns and reporting

Navigating the global landscape of Value Added Tax (VAT) compliance requires more than just periodic reporting; it demands a nuanced understanding and adept management of VAT returns. You can begin by gaining a thorough understanding of the specific VAT regulations in each jurisdiction where your Shopify store is registered. Plus, you have to familiarize yourself with the nuances of reporting requirements, deadlines, and any unique obligations outlined by local tax authorities.

Then, you have to implement a robust system for calculating your VAT liability accurately and verify that your calculations align with the applicable VAT rates, exemptions, and any other region-specific factors. Remember that you need to stay informed about regularly monitoring updates and changes in VAT regulations across the jurisdictions where you operate to be proactive in adapting your reporting processes to align with any alterations in compliance requirements.

Shopify has offered you many powerful tools to facilitate your business. Take the Fordeer PDF Invoice Generator for example. Our Shopify invoice generator supports your businesses in detecting and sending invoices, Guarentee tax and legal compliance in your area and over 50 countries worldwide, depending on the customer’s primary language, and so much more. You can explore now!

Over to you,

In the world of international e-commerce, maintaining global VAT compliance is not just a legal necessity but a strategic imperative. Shopify sellers must equip themselves with the knowledge and tools needed to navigate the intricate web of VAT regulations worldwide.

This comprehensive guide from the Fordeer Team aims to empower Shopify sellers, ensuring they can expand their global footprint while remaining compliant and successful in the ever-evolving eCommerce landscape. We hope it’ll help.

For more invaluable information, stay updated with Fordeer Team!

- Install Fordeer Apps for Free

- Get immediate assistance by chatting with us.

- Join Fordeer Commerce Community for fresh app updates, expert tips, and private deals.