How Invoice Generators Streamline Invoicing for Small B2C Business

Efficient and streamlined invoicing is essential for the success of small business-to-consumer (B2C) enterprises. However, manual invoice creation and management can be time-consuming and error-prone.

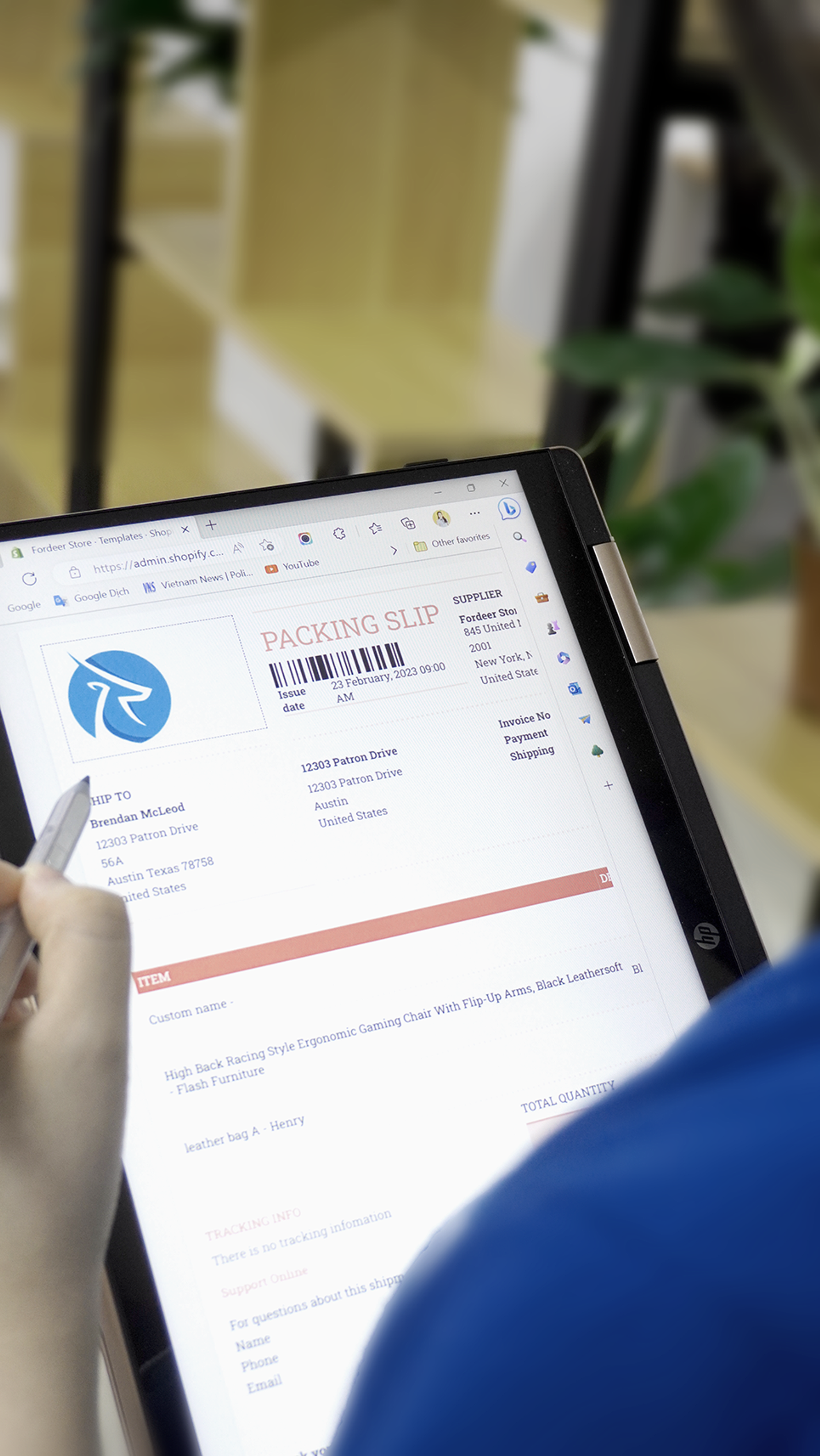

This is where invoice generators come into play. Invoice generators are online tools that automate the process of creating and managing invoices, providing small B2C businesses with a convenient and efficient solution.

In this article, Fordeer will explore the benefits of using invoice generators for small B2C businesses. From saving time and reducing errors to improving professionalism and enhancing cash flow management, invoice generators offer a range of advantages that can significantly boost the invoicing process for small B2C enterprises.

An Overview of How a Small B2C Business Typically Operates

A small business operating in the business-to-consumer (B2C) sector focuses on selling products or services directly to individual consumers. These businesses are typically characterized by their smaller scale, limited resources, and customer-centric approach. Let's delve deeper into the various aspects of how a small B2C business operates:

Identifying the target market

A crucial first step for any small B2C business is to identify its target market. This involves conducting market research to gain insights into consumer preferences, needs, demographics, and purchasing behaviour. By understanding the target market, the business can tailor its products or services to effectively meet consumer demands.

Market research can be conducted through surveys, focus groups, online analytics, or by analyzing industry reports and trends. This information serves as a foundation for the business's marketing strategies, product development, and customer engagement efforts.

Product or service development

Based on the insights gained from market research, a small B2C business develops or sources products or services that align with the target market's requirements. This may involve creating unique, innovative products, curating a selection of goods from various suppliers, or providing specialized services.

Product development includes designing, prototyping, testing, and refining offerings to ensure they meet quality standards and customer expectations. Service-based businesses focus on defining service packages, establishing service delivery processes, and training employees to deliver exceptional customer experiences.

Marketing and promotion

To build awareness and attract customers, small B2C businesses employ a range of marketing and promotional strategies. Effective marketing campaigns help reach the target audience and communicate the value of the products or services offered.

Digital marketing plays a crucial role in today's business landscape. Small B2C businesses leverage online advertising, social media marketing, content creation, search engine optimization (SEO), and email marketing to engage with potential customers. Traditional marketing methods such as print ads, radio spots, and direct mail can also be employed, depending on the business's target market and budget.

Additionally, partnerships with complementary businesses, influencer collaborations, participation in local events, and community outreach efforts can contribute to the business's visibility and reputation.

Sales and customer interaction

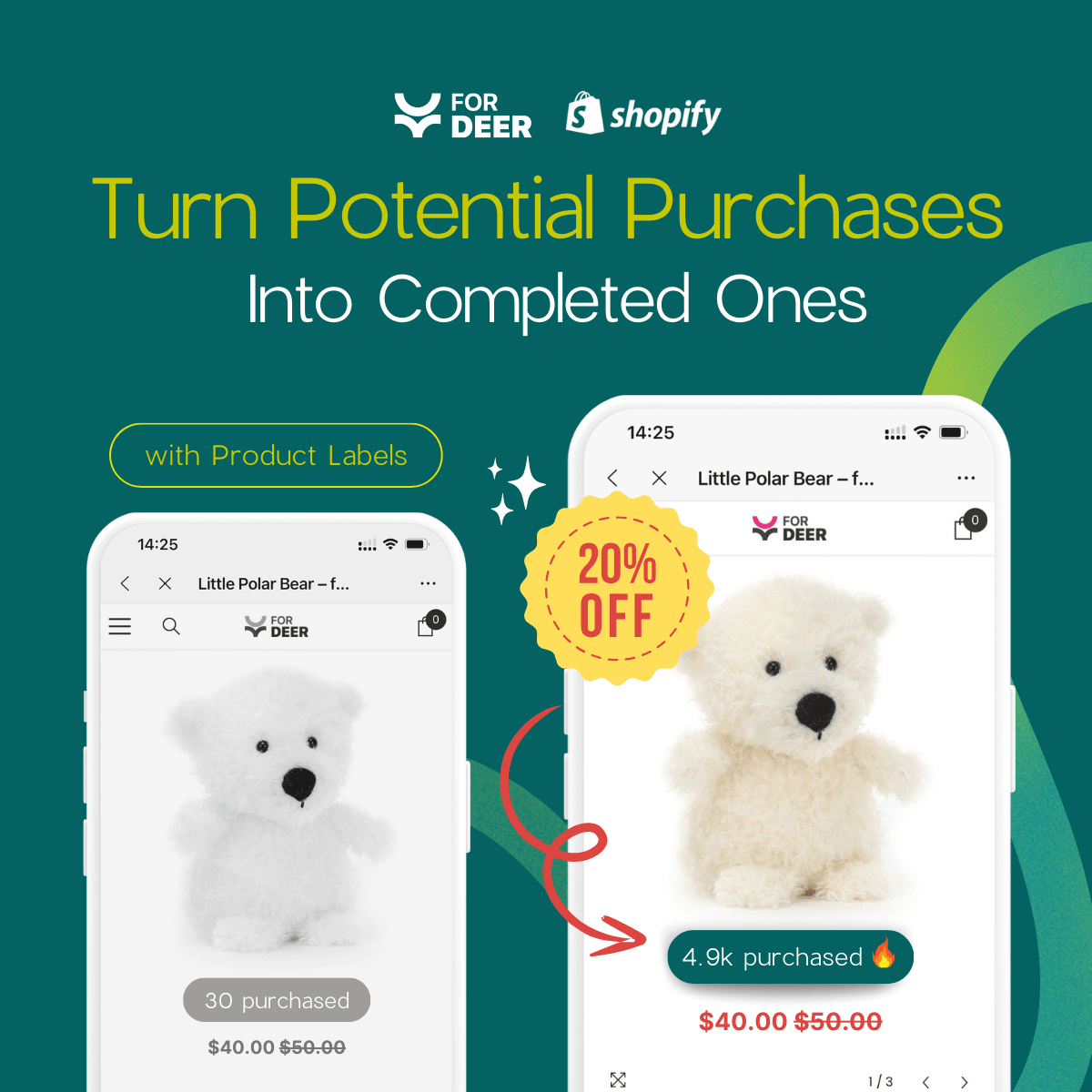

Once potential customers are aware of the business and its offerings, the sales process begins. Small B2C businesses provide various channels for customers to make purchases, including physical retail stores, e-commerce platforms, mobile apps, or a combination of these.

In physical stores, businesses focus on creating inviting environments, visually appealing product displays, and knowledgeable staff to assist customers. For e-commerce, businesses develop user-friendly websites or mobile apps that facilitate easy navigation, product browsing, and secure online transactions.

Small B2C businesses prioritize customer interaction and engagement throughout the sales process. This involves training employees to provide personalized assistance, addressing customer inquiries promptly and professionally, and ensuring a positive shopping experience. Friendly and knowledgeable customer service contributes to customer satisfaction and fosters brand loyalty.

Order fulfilment and delivery

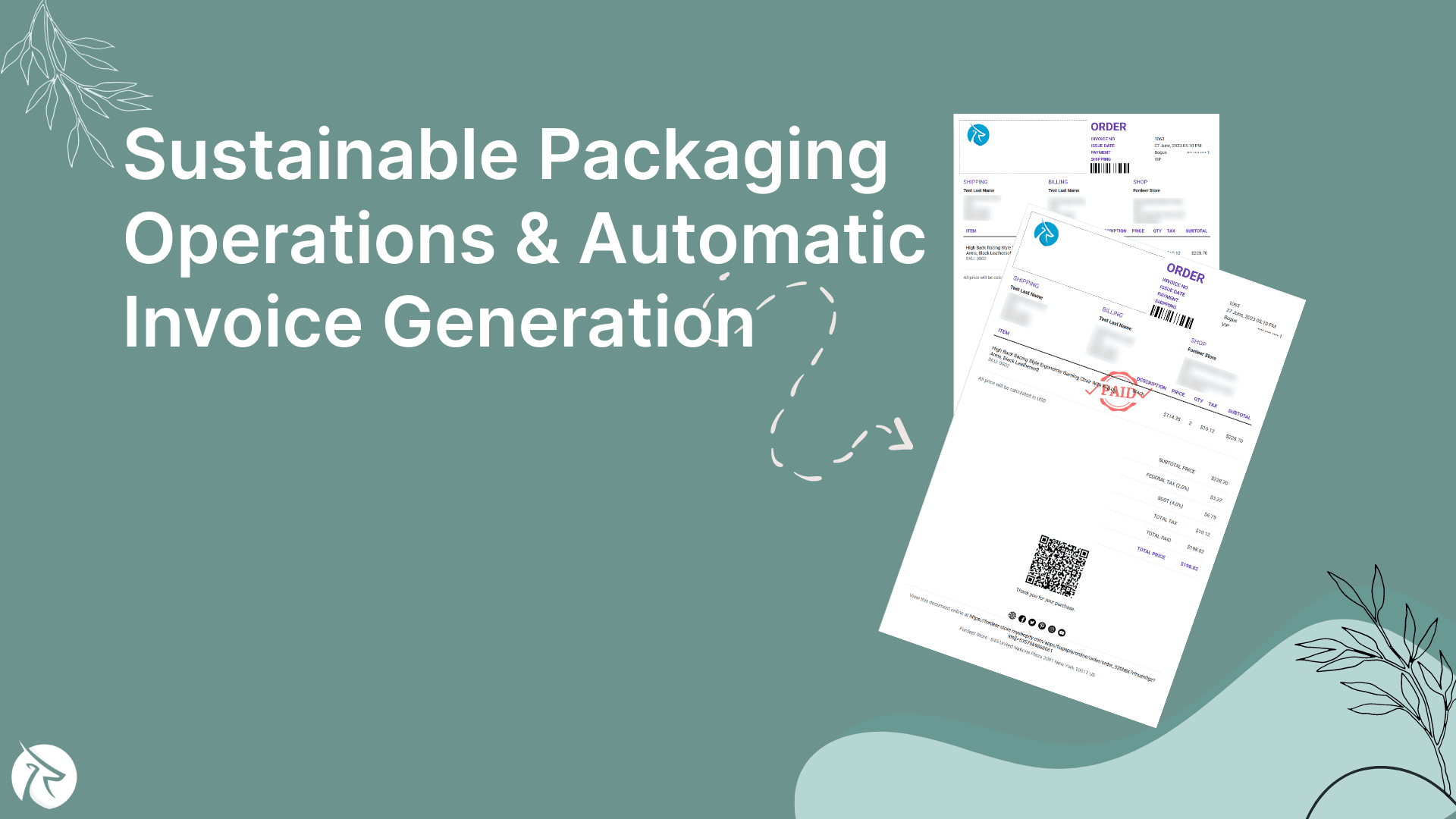

Once customers place orders, small B2C businesses manage the order fulfilment process. This includes tasks such as inventory management, packaging, shipping, and delivery coordination.

Inventory management involves tracking product availability, restocking items, and optimizing inventory levels to meet customer demand. Small businesses may adopt inventory management systems or use manual processes, depending on the scale of their operations.

Packaging plays a vital role in protecting products during transit and can also serve as an opportunity to enhance the brand's visual identity. Small businesses ensure that packaging materials are cost-effective, environmentally friendly, and align with their brand image.

Shipping and delivery logistics vary based on the business's location, the distance to customers, and the shipping options available. Small B2C businesses may handle fulfilment in-house or outsource it to third-party logistics providers (3PLs) who specialize in warehousing, order processing, and shipping.

Customer support and after-sales service

Small B2C businesses understand the importance of providing ongoing support to customers even after the sale is completed. Customer support is crucial for addressing any concerns, providing assistance, and maintaining positive relationships with customers.

Businesses offer various channels for customer support, including phone, email, live chat, and social media platforms. Prompt and effective support helps resolve issues, answer questions, and ensure customer satisfaction. By valuing customer feedback and actively seeking input, small businesses can continually improve their products, services, and customer experiences.

After-sales service is an opportunity to build loyalty and encourage repeat purchases. This can include providing warranties, offering repair services, or extending personalized offers to existing customers. By focusing on long-term customer relationships, small B2C businesses increase customer retention and generate positive word-of-mouth referrals.

Financial management

Managing finances effectively is crucial for the success of small B2C businesses. Financial considerations include pricing, invoicing, payment processing, tracking sales revenue, and managing expenses.

Pricing strategies take into account factors such as production costs, competitors' prices, market demand, profit margins, and perceived value. Small businesses aim to strike a balance between affordability for customers and profitability for the business.

Invoicing plays a vital role in the financial management of small B2C businesses. An invoice is a document that outlines the details of a sale, including the products or services purchased, quantities, prices, and payment terms. Small businesses can use invoice generators to streamline the invoicing process, automate calculations, and ensure accurate and professional-looking invoices.

Payment processing involves offering convenient payment options to customers, such as credit cards, debit cards, digital wallets, or bank transfers. Small businesses may integrate payment gateways into their e-commerce platforms or use point-of-sale systems in physical stores.

Tracking sales revenue and managing expenses are essential for monitoring the financial health of the business. Small businesses employ accounting software or work with accountants to maintain accurate financial records, track revenue, and categorize expenses. This helps with budgeting, tax compliance, and making informed financial decisions.

Continuous improvement and growth

Small B2C businesses strive for continuous improvement and growth to stay competitive in the market. This involves evaluating performance, gathering customer feedback, adapting to market trends, and identifying areas for enhancement.

Analyzing sales data and customer feedback helps small businesses understand which products or services are most popular, identify gaps in the market, and make informed decisions about expanding their offerings. Businesses may introduce new products or services based on customer demand or modify existing offerings to meet evolving consumer needs.

Staying up to date with market trends, consumer behaviour, and emerging technologies is crucial for small B2C businesses. This can involve monitoring industry publications, attending trade shows, participating in industry forums, and leveraging digital tools and analytics to gather insights about consumer preferences and market dynamics.

Small businesses also explore opportunities for growth through geographic expansion, entering new market segments, or diversifying their product or service offerings. Strategic partnerships or collaborations with other businesses can help reach new customer segments and expand the business's reach.

Why Small B2C Business Needs an Invoice Generator

Time-saving efficiency

Manual invoice creation involves gathering customer information, calculating totals, formatting the invoice, and sending it to the recipient.

This process can be time-consuming, especially when dealing with multiple invoices on a regular basis. Invoice generators streamline this process by automating tasks such as data entry, calculations, and formatting.

By simply inputting the necessary information, such as customer details, products or services provided, and payment terms, small B2C businesses can generate professional-looking invoices within minutes. This time-saving efficiency allows business owners to focus on core operations and customer service, ultimately driving business growth.

Error reduction and accuracy

Manual invoicing is prone to errors, such as incorrect calculations, typos, or missing information. These errors can lead to payment delays, disputes, and strained customer relationships. Invoice generators minimize the risk of such errors by automating calculations and ensuring consistent formatting.

The pre-built templates and standardized fields provided by invoice generators help maintain accuracy and professionalism. Additionally, some invoice generators offer features like auto-fill options, customer databases, and product catalogues, further reducing the chances of errors and ensuring that all necessary details are included in the invoice.

Professional branding and customization

Invoices are not just financial documents; they also represent a business's professionalism and brand identity.

Invoice generators allow small B2C businesses to create customized invoices that align with their brand aesthetics and values. With the ability to add logos, brand colors, and personalized messages, businesses can project a cohesive and professional image to their customers.

This branding consistency helps build trust and enhances the overall customer experience. Additionally, invoice generators often provide options for customization, allowing businesses to include specific payment terms, late fees, or discounts, tailoring the invoices to meet their unique requirements.

Streamlined payment processes

Invoice generators facilitate streamlined payment processes for small B2C businesses. They often integrate with various payment gateways, allowing customers to make payments directly from the invoice. This eliminates the need for manual payment reconciliation and reduces the chances of errors or missed payments.

Some invoice generators even offer features like automated payment reminders, enabling businesses to send gentle reminders to customers for outstanding payments. By simplifying the payment process, invoice generators help improve cash flow management and reduce the time spent on following up with customers for payments.

Enhanced record-keeping and reporting

Proper record-keeping is crucial for small B2C businesses for accounting, tax compliance, and financial analysis purposes. Invoice generators provide a centralized platform for storing and organizing invoices, making it easy to retrieve and reference past transactions.

Many invoice generators also offer reporting features, allowing businesses to generate reports on sales, outstanding payments, and revenue trends. These reports provide valuable insights for financial planning and decision-making. By maintaining accurate and accessible records, small B2C businesses can improve their financial management and ensure compliance with regulatory requirements.

Scalability and growth

As small B2C businesses grow, the volume of invoices and customers increases. Manual invoicing processes can become overwhelming and inefficient. Invoice generators offer scalability, accommodating the growing needs of businesses.

They can handle large volumes of invoices and customer data, ensuring that businesses can keep up with demand without compromising efficiency. Invoice generators also allow businesses to easily duplicate or modify templates, making it simple to adapt to changing invoicing requirements. By providing a scalable solution, invoice generators support the growth and expansion of small B2C businesses.

In a Nutshell

Invoice generators are powerful tools that streamline the invoicing process for small B2C businesses. By automating tasks, reducing errors, and improving efficiency, invoice generators save time and resources, allowing businesses to focus on core operations and customer satisfaction. The professional branding and customization options provided by invoice generators enhance a business's image and contribute to building trust with customers.

Moreover, streamlined payment processes, enhanced record-keeping, and reporting capabilities contribute to improved financial management and scalability. By adopting invoice generators, small B2C businesses can optimize their invoicing processes, improve cash flow management, and position themselves for growth and success.