How to Create Professional Invoices with an Online Invoice Generator?

As a business owner, creating professional invoices is a crucial part of managing your finances and maintaining healthy cash flow. Invoicing not only helps you get paid on time but also helps you keep track of your transactions and establish a positive relationship with your customers.

However, creating invoices manually can be time-consuming and prone to errors. This is where an online invoice generator can come in handy. This article will explore how to create professional invoices with an online invoice generator.

Choose the Right Online Invoice Generator

The first step in creating professional invoices with an online invoice generator is to choose the right one for your business needs. Many online invoice generators are available, each with itsfeatures and pricing plans. Some invoice generators offer basic features, such as customizable templates and automated data entry, while others offer more advanced features, such as payment integration and automated reminders.

When choosing an online invoice generator, consider the following factors:

- Features: Look for an invoice generator that offers the features you need to create professional-looking invoices quickly and easily.

- Pricing: Consider the pricing plans of different invoice generators and choose one that fits your budget.

- User-friendliness: Choose an invoice generator with an easy-to-use interface that allows you to create and send invoices quickly and easily.

- Customer support: Look for an invoice generator with reliable customer support to help you resolve issues or answer any questions.

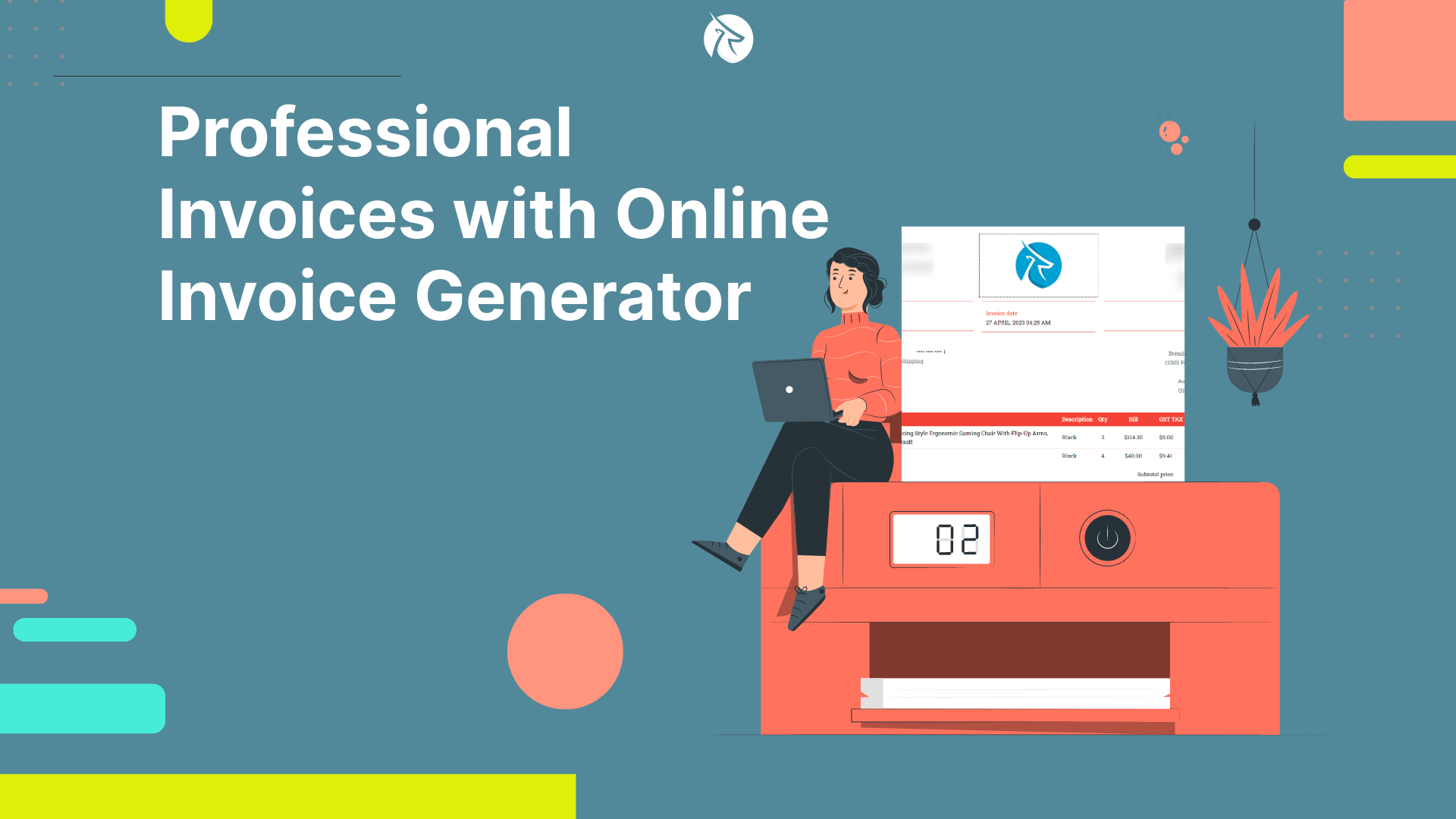

How to Create Professional Invoices with an Online Invoice Generator

Customize your invoice template

Once you have chosen the right online invoice generator, the next step is to customize your invoice template. Most online invoice generators offer customizable templates that allow you to add your business logo, payment terms, and other essential details to your invoices.

Customizing your invoice template can help you establish a professional image with your customers and differentiate your brand from the competition. When customizing your invoice template, consider the following tips:

- Choose a template that reflects your brand identity and business values.

- Add your business logo and contact information to establish brand recognition.

- Include clear payment terms, such as due date, payment method, and late payment fees.

- Customize the design and layout of your template to make it visually appealing and easy to read.

Automate data entry and calculation

One of the main advantages of using an online invoice generator is that it can automate data entry and calculation, reducing the risk of errors and saving you time. Most invoice generators allow you to input the details of your transaction, such as the item or service sold, the quantity, and the price, and automatically calculate the total amount due.

Automating data entry and calculation can help you create accurate invoices quickly and easily. When using an online invoice generator, be sure to check the accuracy of the data and the measures before sending the invoice to your customer.

Include payment options

Another critical aspect of creating professional invoices is to include payment options. Most online invoice generators allow you to integrate payment gateways, such as PayPal or Stripe, into your invoices, making it easy for your customers to pay online.

Including payment options can help you get paid faster and reduce the risk of late payments or disputes. When having payment options on your invoices, be sure to include clear instructions on how to pay and any fees or restrictions associated with the payment method.

Follow up with automated reminders

Finally, following up with automated reminders is essential to creating professional invoices. Most online invoice generators allow you to set up automated payment reminders that remind your customers of upcoming or overdue payments.

Automated reminders can help you get paid faster and maintain a healthy cash flow. When setting up automated reminders, be sure to choose the right frequency and tone that aligns with your brand and customer relationship.

Automated payment reminders are essential for businesses looking to maintain healthy cash flow and reduce the risk of late payments. Setting up automatic payment reminders can help you remind your customers of upcoming or overdue payments without having to send reminders manually every time. Here are some best practices for setting up automated payment reminders:

Choose the right frequency

The first best practice for setting up automated payment reminders is to choose the right frequency. You want to send reminders at a frequency that is frequent enough to remind your customers of upcoming or overdue payments but not so frequent that it becomes annoying or spammy.

Most businesses send automated payment reminders at regular intervals, such as once a week or once every two weeks. You can also set up reminders to be sent at specific intervals before or after the due date, such as three days before the due date or one day after the due date.

Personalize your reminders

The second best practice for setting up automated payment reminders is to personalize your reminders. Automatic reminders can sometimes come across as impersonal or robotic, which can make your customers feel disconnected from your business.

To personalize your reminders, you can add personal touches such as addressing your customers by name, using a friendly tone, and including relevant details such as the amount due and the due date. Personalizing your reminders can help you establish a positive relationship with your customers and encourage them to pay on time.

Use the right channels

The third best practice for setting up automated payment reminders is to use the proper channels. You want to send reminders through media that your customers are likely to check, such as email or SMS.

Most businesses use email as the primary channel for sending automated payment reminders, as it is a reliable and widely used communication channel. However, depending on your customer base, you may also want to consider using other channels, such as SMS or push notifications.

Provide clear instructions

The fourth best practice for setting up automated payment reminders is to provide clear instructions on paying. You want to make it as easy as possible for your customers to pay without searching for payment instructions or information.

Include clear instructions on how to pay, such as payment methods accepted, payment deadlines, and any fees or restrictions associated with the payment method. Providing clear instructions can help you avoid confusion and reduce the risk of errors or delays.

Monitor and adjust

The final best practice for setting up automated payment reminders is to monitor and adjust your reminders over time. You want to make sure that your reminders are helping you get paid on time and not causing any negative impact on your customer relationships.

Monitor the effectiveness of your reminders over time, such as the open rates and response rates, and adjust your reminders as needed. For example, you may want to adjust your reminders' frequency, tone, or channels based on the customer's response and feedback.

Setting up automated payment reminders can help you maintain a healthy cash flow and reduce the risk of late payments. By following best practices such as choosing the right frequency, personalizing your reminders, using the right channels, providing clear instructions, and monitoring and adjusting over time, you can create effective reminders that help you get paid on time and maintain positive customer relationships.

Conclusion

In conclusion, creating professional invoices with an online invoice generator can help you streamline your invoicing process, reduce the risk of errors, and maintain a positive relationship with your customers.

By choosing the right online invoice generator, customizing your invoice template, automating data entry and calculation, including payment options, and following up with automated reminders, you can create professional invoices that reflect your brand identity and help you get paid on time.