Invoicing on-the-go: The Benefits of PDF Invoice for Small Businesses

Small businesses often face many challenges when it comes to invoicing. Invoicing on-the-go can be incredibly challenging, as it requires a system that is flexible, efficient, and easy to use. One of the best solutions for small businesses is to use PDF invoices. In this article, we will explore the benefits of PDF invoices for small businesses.

Obstacles that Small Businesses Have to Face with the Invoicing Process

Invoicing is critical to running a small business, as it is how you get paid for your products or services. However, invoicing can be challenging for small businesses, as they often lack the resources and infrastructure of larger businesses. In this article, we will explore the obstacles small businesses face with invoicing.

Time-consuming

Invoicing can be a time-consuming process, especially for small businesses that have limited resources. Creating invoices, sending them to clients, and following up on late payments can take up a significant amount of time that could be better spent on other aspects of the business, such as marketing or customer service.

Lack of automation

Small businesses often lack the infrastructure to automate their invoicing process. This means that they may have to create invoices manually, send them via email or snail mail, and then follow up on late payments. This manual process can be prone to errors and can be a significant drain on time and resources.

Difficulty tracking payments

Tracking payments can be a significant challenge for small businesses, especially if they have multiple clients and invoices to manage. Keeping track of which invoices have been paid, which are overdue, and which are outstanding can be a time-consuming and confusing process.

Late payments

Late payments can be a significant issue for small businesses, as it can impact their cash flow. Small businesses often have limited resources, and late payments can make it difficult to pay bills and meet financial obligations. Following up on late payments can also be time-consuming and frustrating.

Lack of professionalism

Small businesses may lack the resources to create professional-looking invoices, which can impact their business image. Invoices that are poorly designed or lack important information can make a small business appear unprofessional and may impact its ability to attract and retain clients.

Difficulty with tax compliance

Small businesses may struggle with tax compliance when it comes to invoicing. They may not be aware of the tax laws in their jurisdiction, which can lead to errors and penalties. Invoicing software that is not up-to-date with tax laws can also create issues for small businesses.

Not keeping accurate records

One of the most common mistakes that small businesses make when it comes to tax compliance and invoicing is not keeping accurate records. This can include failing to keep track of all income and expenses, not maintaining proper documentation of transactions, and not keeping invoices and receipts.

Not charging or collecting sales tax

Small businesses that sell products or services may be required to charge and collect sales tax. Failing to do so can result in penalties and fines. It is important for small businesses to understand the sales tax requirements in their jurisdiction and to ensure that they are charging and collecting the correct amount of sales tax.

Limited payment options

Small businesses may have limited payment options, which can make it difficult for clients to pay them. They may not have the infrastructure to accept credit card payments or may not be able to accept payments from clients in other countries.

The Benefits of PDF Invoice for Small Businesses

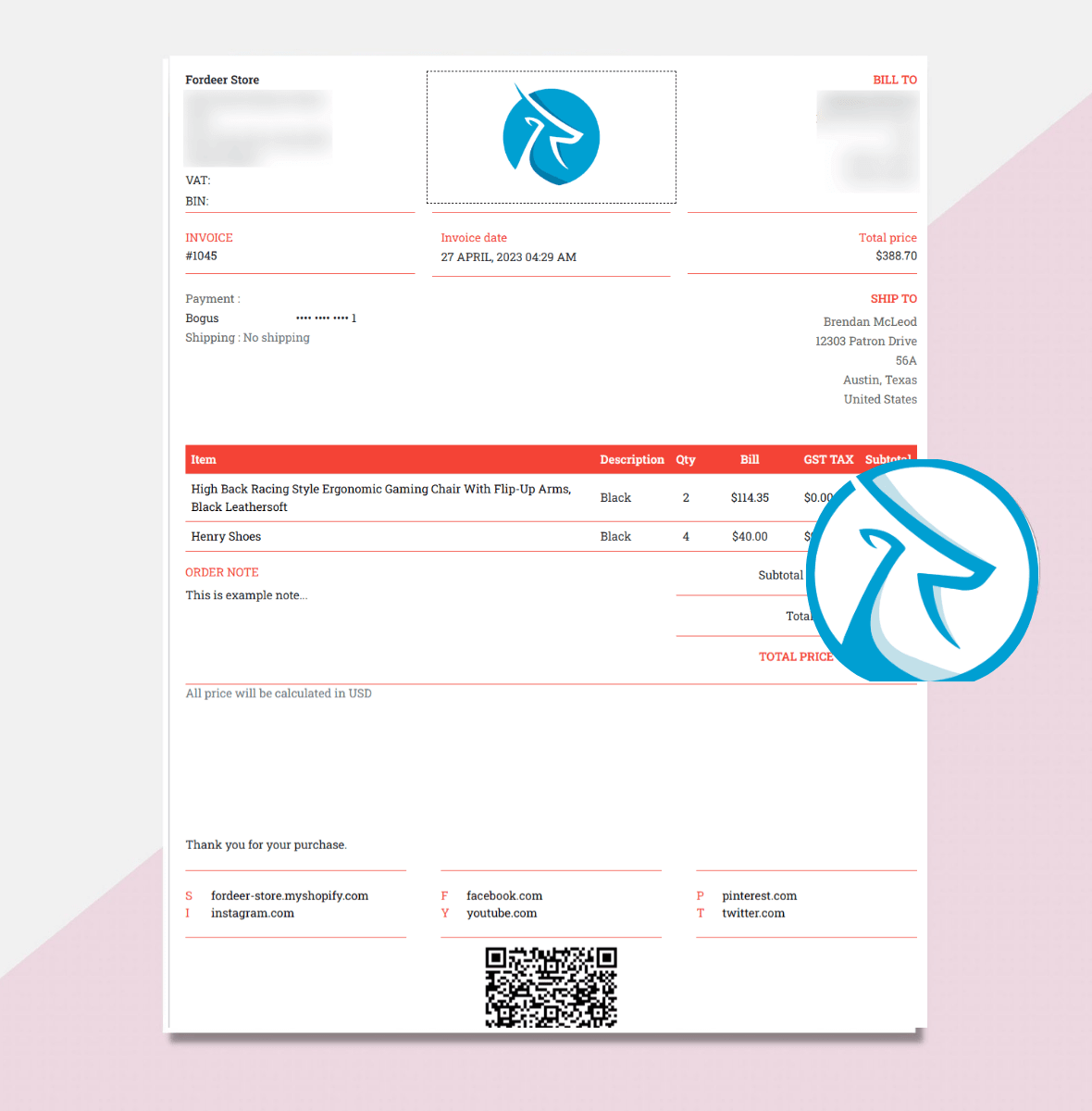

Fully customize with flexibility

PDF invoices are very flexible and can be easily customized to meet your business needs. You can add your company logo, change the colors, and add your own unique design. This flexibility allows you to create a professional invoice that reflects your brand and helps you stand out from the competition.

Work everywhere, every time with accessibility

PDF invoices are accessible from anywhere, making them ideal for small businesses that need to invoice on-the-go. You can create an invoice from your laptop, smartphone, or tablet, and then email it to your client. This means that you can create and send an invoice as soon as the work is complete, which can help improve your cash flow.

Easy to create and send

PDF invoices are very easy to create and send. You can use software such as Microsoft Word or Google Docs to create an invoice template, and then save it as a PDF. Once the PDF is created, you can easily email it to your client. This process is much faster and more efficient than creating a paper invoice and mailing it to your client.

Presence of professionalism in your customers’ eyes

PDF invoices look very professional and can help improve your business image. A professional-looking invoice can help you stand out from the competition and build trust with your clients. This can lead to repeat business and referrals, which can help grow your business.

Cost-effective

PDF invoices are very cost-effective, as they do not require any printing or postage costs. This can be especially beneficial for small businesses that have limited resources. By using PDF invoices, you can save money on printing and postage costs, which can help improve your bottom line.

Simple to monitor

PDF invoices are very easy to track, as they can be saved to a folder on your computer or in the cloud. This makes it easy to keep track of all your invoices and payments, which can help improve your financial management. You can also easily search for specific invoices, which can save you time when you need to find an invoice quickly.

Easy to store

PDF invoices are very easy to store, as they can be saved to a folder on your computer or in the cloud. This means that you do not need to keep paper copies of your invoices, which can save you space and reduce clutter in your office.

Make it easy to share

PDF invoices are very easy to share with your accountant or bookkeeper. You can simply email them the PDF, and they can easily import it into their accounting software. This can save you time and reduce the risk of errors, as they do not need to enter the data into their system manually.

Conclusion

PDF invoices offer several benefits to small businesses. They are a secure, professional, and efficient way to manage invoicing and payment processes. By using PDF invoices, small businesses can save time and money, improve their cash flow, and enhance their professional image. PDF invoices can also help small businesses stay organized and comply with tax laws and regulations.

With the many advantages that PDF invoices offer, small businesses can streamline their invoicing processes and focus on growing their business. Therefore, small businesses should consider using PDF invoices to enhance their invoicing and payment processes.