VAT Management Solutions for Shopify Invoicing

Managing Value Added Tax (VAT) efficiently is crucial for Shopify store owners. As businesses expand globally, ensuring compliance with varying VAT regulations becomes a daunting task.

Let’s explore the importance of VAT management for Shopify invoicing and introduce effective solutions to streamline the process with Fordeer!

Understand the significance of VAT management

Basics of VAT management

Value Added Tax (VAT) management is a crucial aspect of financial operations for businesses, especially those involved in international trade. VAT is a consumption tax levied on the value added to goods and services at each stage of the production and distribution chain. It is an indirect tax, meaning that the end consumer ultimately bears the cost.

Issuing VAT invoices is a legal requirement for businesses registered for VAT. Invoices must include details such as the seller’s and buyer’s VAT numbers, a description of the goods or services, the total amount excluding VAT, and the amount of VAT.

VAT management becomes more and more important as businesses are engaged in international trade. Businesses now have to understand and stay compliant with cross-border VAT regulations to avoid penalties and legal issues. To streamline the VAT management process, businesses often use specialized software that automates calculations, generates VAT-compliant invoices, and assists in the preparation of VAT returns.

Challenges faced by Shopify store owners

Managing VAT (Value Added Tax) in the context of Shopify invoicing is a multifaceted task that includes the handling of diverse currencies, navigating through fluctuating tax rates, and staying abreast of dynamic regulatory changes. The intricacies involved in managing VAT for Shopify businesses are compounded by the global nature of eCommerce, where transactions span various regions and jurisdictions.

When VAT is manually tracked and calculated, the inherent complexities can result in errors that pose a significant risk to compliance. The ever-evolving landscape of tax regulations adds a layer of challenge, making it imperative for businesses to proactively address these complexities. Failure to do so not only jeopardizes financial accuracy but also exposes businesses to potential legal and regulatory consequences.

In this dynamic environment, automation emerges as a key solution to mitigate these challenges. The implementation of automated VAT management systems not only offers precision in calculations but also introduces efficiency into the entire invoicing process.

By automating, businesses can seamlessly handle transactions involving multiple currencies, accurately apply diverse tax rates, and effortlessly adapt to regulatory changes. This not only safeguards against compliance issues but also frees up valuable time for business owners and their teams to focus on strategic initiatives and core business operations.

Benefits of VAT management solutions for Shopify

Automated compliance

The integration of automated compliance mechanisms within Value Added Tax (VAT) management solutions marks a pivotal advancement in the realm of financial processes. These cutting-edge solutions play a crucial role in the seamless and error-free calculation of taxes, mitigating the inherent risks associated with manual calculations and ensuring robust compliance with tax regulations across diverse regions.

The implementation of automated compliance features addresses the perennial challenge of human error in tax calculations, which can be especially pronounced when dealing with intricate tax structures prevalent in different global jurisdictions. By harnessing the power of automation, VAT management solutions significantly reduce the likelihood of miscalculations, offering a reliable and efficient means to navigate the complexities of tax compliance on an international scale.

Real-time tax rate updates

In the global landscape of eCommerce, tax rates are subject to frequent revisions and updates. With that in mind, businesses have to stay updated and informed about these changes as it is paramount to navigating the intricacies of international trade. Automated systems designed to monitor and incorporate real-time updates on tax rates provide businesses with a strategic advantage in ensuring that their invoicing processes align seamlessly with the prevailing tax regulations of each specific country.

Furthermore, the automated compliance features are not just about tax calculations. These sophisticated solutions often incorporate real-time updates on changing tax regulations, ensuring that businesses are well-informed and able to promptly adjust their processes to remain in compliance. This proactive approach not only enhances accuracy in tax management but also demonstrates a commitment to staying abreast of the dynamic regulatory landscape.

Efficient reporting

Effective VAT management can effortlessly create detailed reports tailored for Value Added Tax (VAT), you can streamline your compliance efforts with tax authorities and simplify the audit process. This user-friendly feature not only facilitates adherence to tax regulations but also offers a seamless and effective approach to managing your financial responsibilities.

The convenience of generating detailed reports contributes significantly to the overall efficiency of your VAT management. Simplifying the auditing process becomes a natural outcome, as these reports serve as a transparent record of your financial transactions, fostering a sense of trust and reliability with both tax authorities and internal stakeholders.

Seamless integration

Creating a seamless connection between your Shopify store and the VAT management solution will craft an effortlessly delightful experience for both sellers and shoppers. This integration not only eliminates the complexities typically associated with tactic management but also adds a touch of convenience to your eCommerce operations.

With the VAT management solution seamlessly integrated into your Shopify store, you can bid farewell to the manual intricacies that often accompany tax calculations. By implementing this approach, you can save time, minimize errors, and maintain compliance effortlessly and your focus can now shift from navigating tax complexities to propelling your business forward.

Moreover, a seamlessly integrated VAT management solution ensures that the shopping experience remains smooth and transparent. With accurate tax calculations in real-time, your customers can trust that they’re being charged fairly, fostering trust and loyalty. Your customers will experience no hidden surprises, just a straightforward and enjoyable shopping experience.

VAT management solutions for Shopify invoicing

Implementing VAT management for Shopify

When selecting a VAT management solution for your Shopify store, it's essential to find one that not only meets your specific needs but also integrates with your existing systems. This ensures a smooth and efficient workflow, minimizing disruptions to your business operations.

To begin this process, you should take a moment to assess your store’s requirements and the complexity of your international transactions. Also, you should take into consideration such as the variety of products you offer, the countries you operate in, and the intricacies of different tax regulations.

Beyond integration, it’s crucial to ensure that the selected VAT management solution provides comprehensive support for international transactions. This includes the ability to handle multiple currencies, adapt to varying tax rates across different regions, and stay up-to-date with dynamic regulatory changes. This not only guarantees accurate calculations but also positions your business to navigate the complexities of cross-border trade effortlessly.

Top VAT management solutions for Shopify

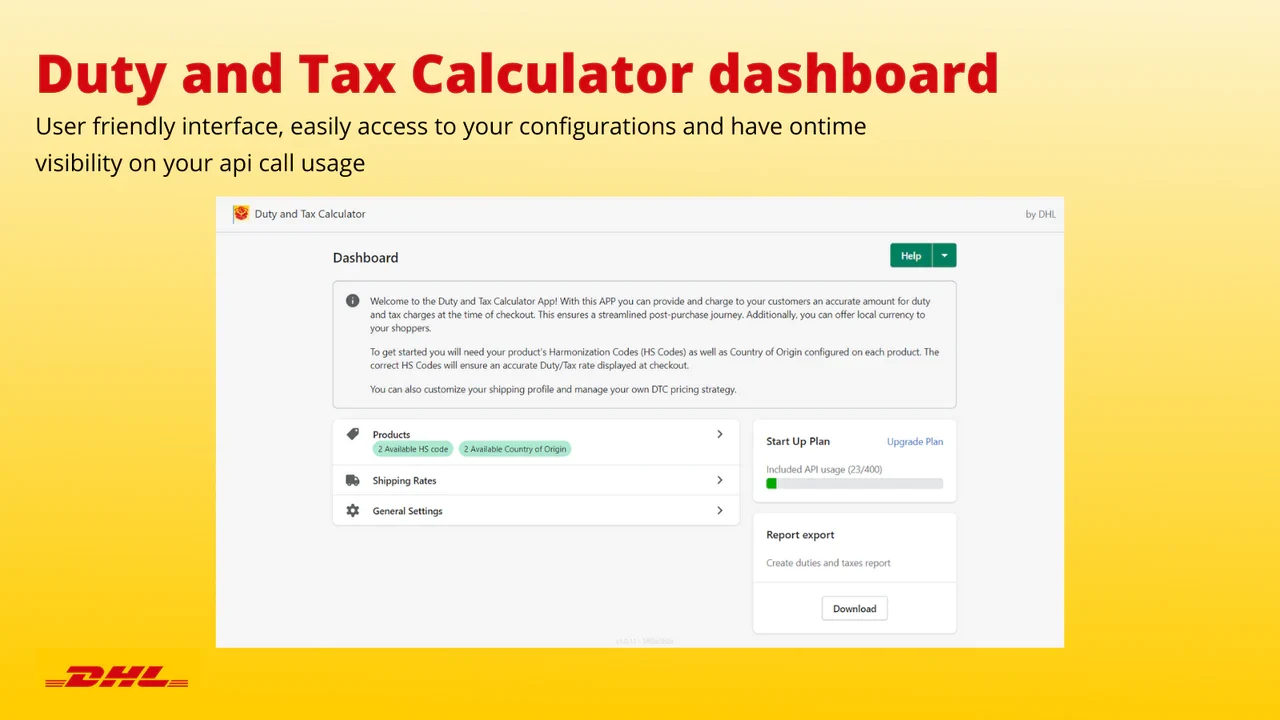

DHL Duty and Tax Calculator

Overview

Embarking on a seamless international shipping experience with DHL’s versatile Duty and Tax Calculator, designed to cater to the unique needs of all merchants. This innovative tool empowers businesses of all sizes to effortlessly calculate duties, taxes, and additional import fees, offering a transparent breakdown based on a customer’s shopping cart.

With DHL Duty and Tax Calculator, businesses can navigate global trade with confidence, armed with a tool that goes beyond calculation. DHL’s commitment to providing a user-friendly experience extends to ensuring the Duty and Tax Calculator easily integrates into your existing operations. This means that you can maintain your preferred workflow when enhancing the transparency and accuracy of your shipping processes.

Key features

- Revolutionize your checkout: real-time duties and taxed, international bliss in 200+ countries

- Unlock a world of eCommerce: seamless checkout, domestic comfort in global shipping

- International harmony: effortless workflow, 200+ countries, and real-time duties at checkout

- Strategic pricing mastery; empower merchants with real-time duties and taxes for optimal control

Rating: 5/5

Pricing plan: 30-day free trial, $90-$765/month

Check it out now: DHL Duty and Tax Calculator

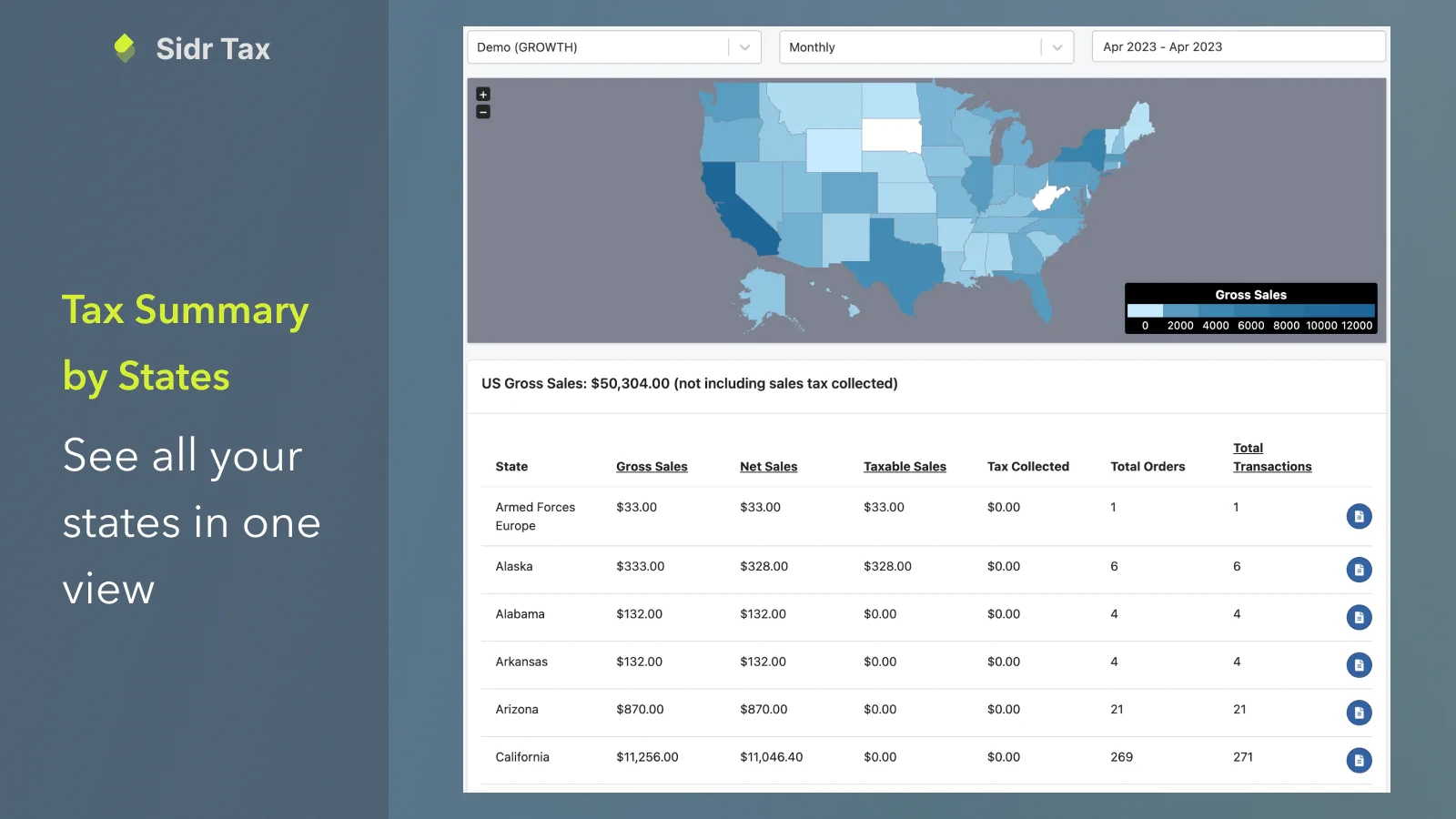

Sidr - Sales Tax Automation

Overview

Sidr - Sales Tax Automation is designed to simplify the often complex process of creating and filling sales tax reports with state websites, making it an effortless journey from start to finish. Sidr - Sales Tax Automation takes pride in offering a comprehensive suite of services that cover every aspect of your sales tax compliance needs.

The main solution lies in the generation of reports based on the actual tax you’ve collected. This not only ensures accuracy but also provides a transparent overview of your financial transactions, giving you peace of mind. Whether you’re small business owner or managing a larger enterprise, you can relax and Sidr Tax will handle the rest with precision.

Key features

- Streamline your tax filling with autofill and stay ahead of deadlines

- Economic nexus navigator: discover the perfect time to begin tax collections - never miss a beat

- Precision in numbers: unleash accurate tax reports, always ready for export and up-to-date

- Seamless registration: let us secure your sales tax permit right on time for your business

- Instant answers with chat support

Rating: 5/5

Pricing plan: 15-day free trial, $19-$89/month

Check it out now: Sidr - Sales Tax Automation

Zonos Duty and Tax

Overview

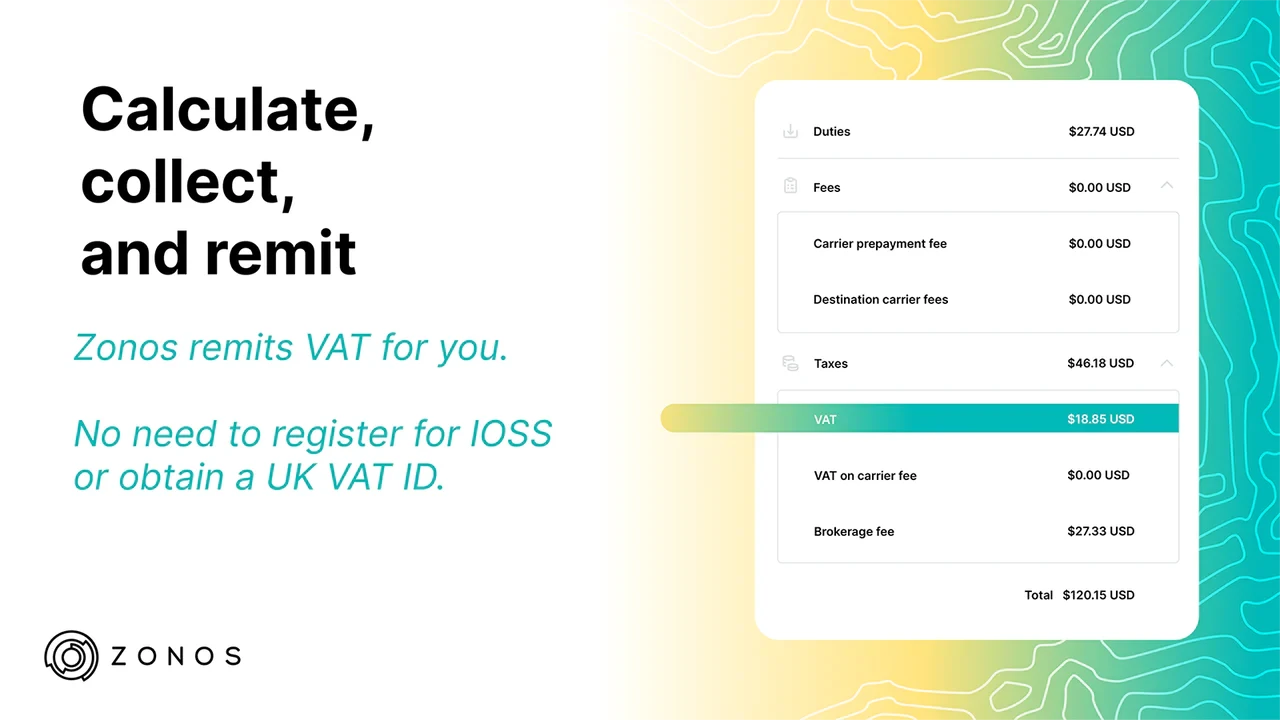

Zonos Duty and Tax can be your trusted partner in a cross-border sling, simplifying the complexities of international transactions. Zonos automated cross-border tax compliance solutions are designed to empower businesses like yours. Zonos offers a comprehensive suite of services, including guaranteed landed cost calculations, streamlined duty and tax collection, vigilant monitoring of VAT thresholds, and facilitation of in-country tax registration and remittances, such as UK VAT and IOSS.

Key features

- Zonos covers the duty and tax tab: say goodbye to billing hassles

- Zonos handles your VTA: no IOSS registration or UK VAT ID required

- Take the wheel: connect your owner carrier accounts for complete control of your shipping rates

- Unlock savings: save up to 50% off advancement fees (UPS, DHL, FedEx)

- Effortless cross-border labels: craft compliant labels with ready-to-go customs docs

Rating: 4.9/5

Pricing plan: 14-day free trial, $208.33 - $333.33/month

Check it out now: Zonos Duty and Tax

Wrap up,

Efficient VAT management is crucial for the success of your Shopify store, especially when operating on a global scale. By implementing dedicated VAT management solutions, you can automate processes, reduce errors, and ensure compliance with international tax regulations.

Streamline your Shopify invoicing with these solutions Fordeer Team allows you to focus on growing your business while leaving the complexities of VAT management behind!