What are the different types of invoices?

No matter how big or little, running a business or a profession requires invoices. Depending on the sector, stage and form of the business transaction, and the GST law, different types of invoice documents are utilized. Invoices support record-keeping, payment monitoring, and company analytics. In order to prevent wasting time, money, and the efforts of the parties engaged in the transaction, it is necessary to adopt and apply the appropriate form of invoice for a given transaction.

You can easily have the great billing and invoicing tool with Fordeer Invoice Order Printer, which offers flexible customization options and makes it simple to create most of these invoice formats. You may start creating customized and expertly designed invoices and other documents on Fordeer to launch your business on the path to expansion!

Let's examine the numerous invoice kinds and papers that companies typically utilize for daily transactions.

Overview of invoicing types

Depending on the phases of a transaction, billing or invoicing can be carried out. For instance, when a buyer places a first order, the supplier or seller may send a proforma invoice or estimate. Similarly, when the seller completes the transaction or the product is actually sold at the last stage, the final invoice is raised.

If the transaction involves a major project with numerous performance phases that include payment commitments, such as construction projects, an interim invoice or progress invoice may also be raised between these two stages.

When the credit time permitted in the final invoice ends, the seller may issue a past-due invoice and repeat the terms of the original invoice with a late fee or interest for late payment. Continuous or ongoing services could necessitate the seller issuing recurrent invoices in circumstances like a simultaneous bank audit.

After generating the final invoice, credit notes and debit notes can be used to correct any financial error, account for sales and buy returns, or reflect after-sale discounts.

The convenience of conducting business is improved by some documents that are more regularly used, such as delivery notes, goods receipt notes, expenditure reports, etc. These documents assist other organizational departments in keeping track of the inflow and outflow of items.

Under the GST and indirect tax legislation in India, a limited number of invoices and documentation are required. A GST-registered business is required to provide GST-compliant invoices. The invoice must adhere to the criteria for invoicing and contain the information required by law.

Similar requirements apply to the issuance of e-invoices by a particular class of GST-registered enterprises. Such organizations frequently employ invoicing papers like e-way bills, ISD invoices, receipt and payment vouchers, refund invoices, or vouchers.

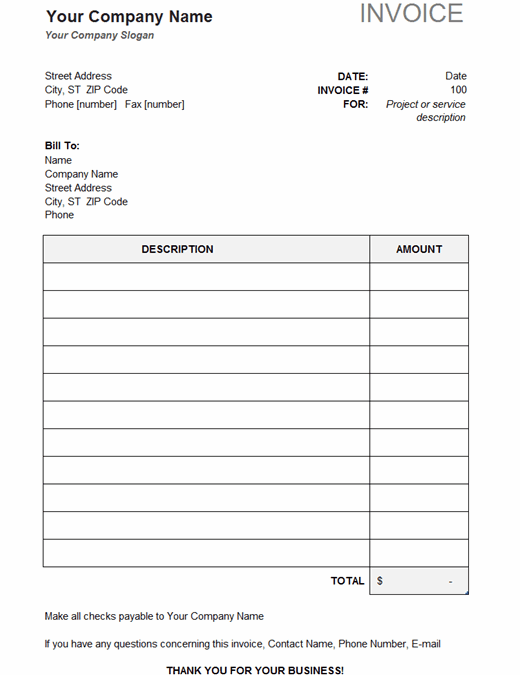

Standard invoice

The final invoice is another name for a normal invoice. A business or professional uses it, and they are typically not registered under any indirect tax regulations. It is a typical type of invoice that small firms use, and it can be customized to meet specific demands and industry norms.

The name and contact information for the buyer and seller, the invoice number, the date the invoice was issued, a description of the goods or services provided, the rate and amount charged for each good or service, and the total amount payable are all included in a standard invoice.

Tax invoice

An invoice raised by a seller who is registered for GST, the former VAT, service tax, etc. is referred to as a tax invoice. A supplier is required to provide an invoice for each and every taxable sale or supply they make.

The buyers who have registered for GST are able to claim the input tax credit with the use of a GST-compliant invoice as proof. Additionally, firms risk severe fines if they fail to issue a tax invoice within the GST law's deadline.

A GST invoice includes details about the transaction, including the sale's description, amount, and HSN code, as well as the buyer's and seller's addresses and GSTINs (if applicable). Most significantly, it includes the taxable value, accompanying tax rate, and tax amount for each sold item. Additionally, it serves as a legal document. A tax invoice must be signed or electronically signed by the organization's authorized signatory in order for the buyer to be able to use it.

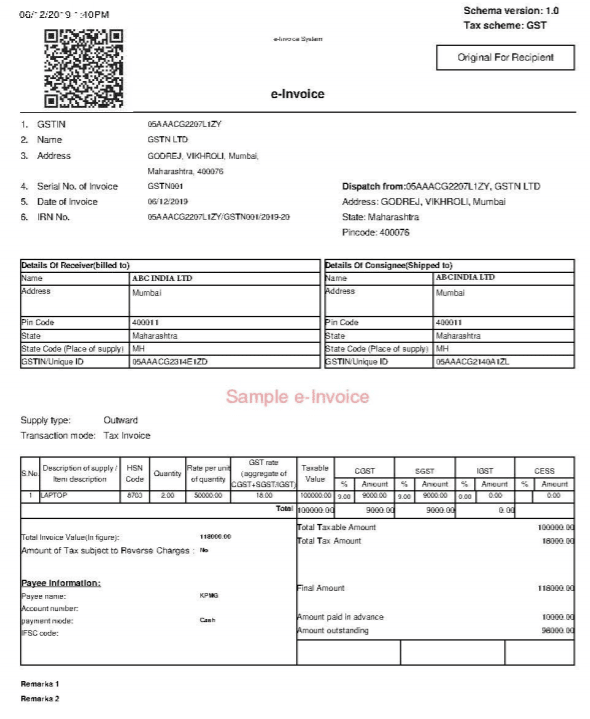

e-Invoice

A GST-compliant invoice certified by the GST Network is known as a "e-Invoice" or "electronic invoice" (GSTN). With effect from October 1, 2020, e-Invoicing is a government and tax department endeavor to combat the growing problem of false invoicing practices in India. Regular taxpayers under the GST statute with a yearly turnover above a specified threshold are subject to it.

In addition to confirming and authenticating such invoices by assigning a distinct Invoice Reference Number (IRN) and signed QR code via the Invoice Registration Portal, the GSTN also checks for any duplication (IRP). It is an electronic invoice that has been verified by the government.

As a result, it is a crucial and reliable document for tax purposes. The same penalty as a GST invoice is applied if the notified enterprises fail to raise the e-invoice.

Proforma invoice

An initial or tentative invoice sent by the seller to the buyer that includes exact estimations of the goods or services that the supplier is expected to deliver is referred to as a proforma invoice. It confirms the seller's promise to provide the buyer with goods and services at the agreed-upon set price.

It is sometimes referred to as a quote or estimate. The issuance of this invoice precedes the completion of the sale. The buyer will issue a purchase order or open a letter of credit to the seller after obtaining the proforma invoice from the seller.

In addition to other information regarding the transaction, it contains a description of the products and an estimated total amount owed.

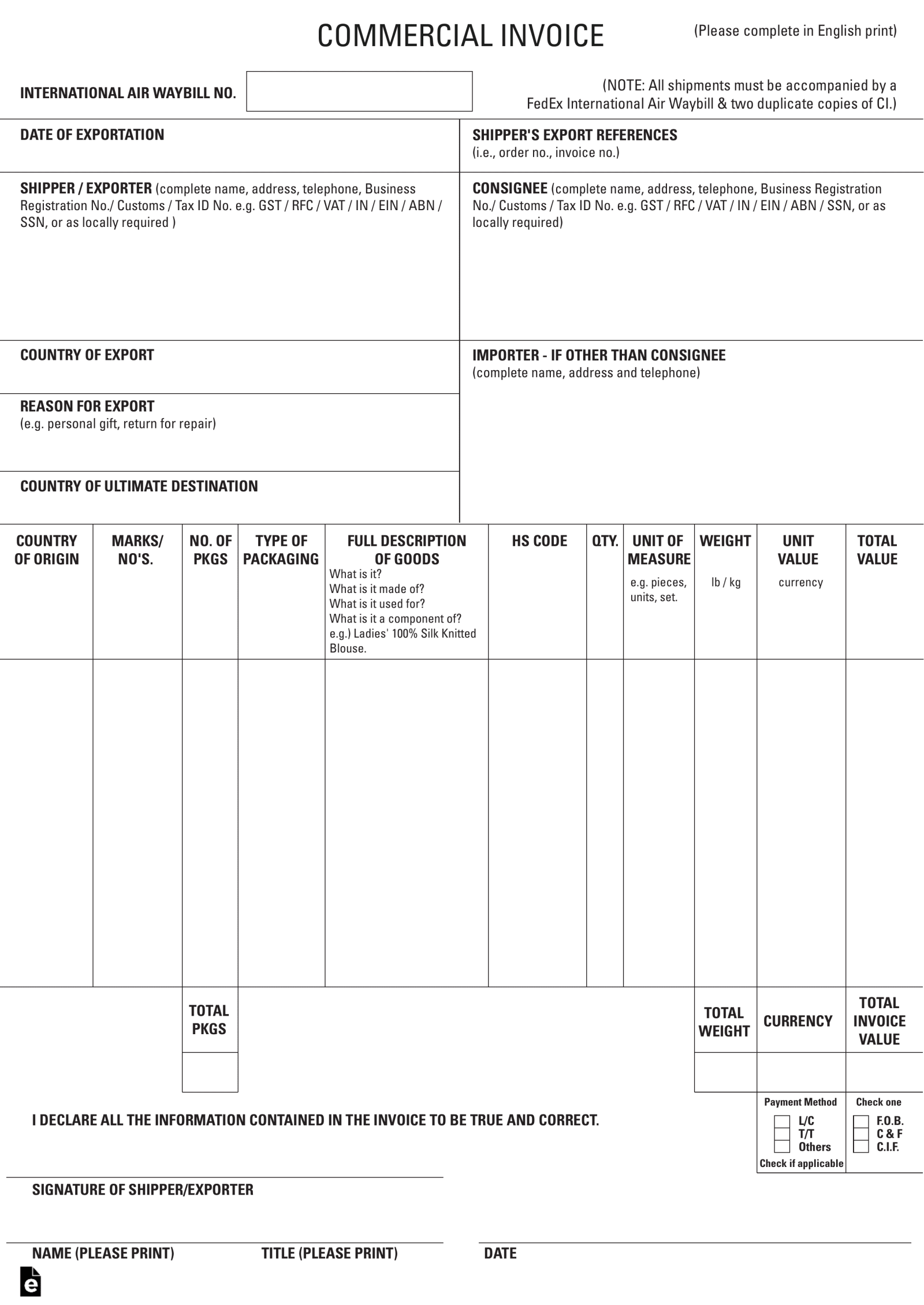

Commercial invoice

For commodities that are exported to importers and sold on a global scale, businesses issue commercial invoices. Such invoices serve as a customs declaration because they are required to calculate customs charges for international transactions.

The shipment quantity, weight/volume of the consignment, product description, packing type, and total value are all included in a business invoice.

Timesheet invoice

When hourly billing is required or time becomes the most important aspect of the task or transaction, a timesheet invoice is used. Professionals and contract employees, such as lawyers, advertising firms, psychologists, and business consultants, can benefit from it. Rentals of vehicles, costumes, tents, and other items are also frequently made use of.

These invoices list the time spent on the service or the promised deliverable instead of the product, together with the regular pay rate.

Credit notes

The credit note, which is also known as a credit invoice or credit memo, shows a reduction in the amount of a final invoice, standard invoice, or tax invoice. It results in a reduction in the sum that the customer owes the company as a result of sales returns, which may be brought on by damaged goods or for any other cause, or as a result of after-sales discounts.

These invoices serve as evidence of the adjustments made to the figures indicated in the final invoice that was previously issued and are useful in the event of future disputes.

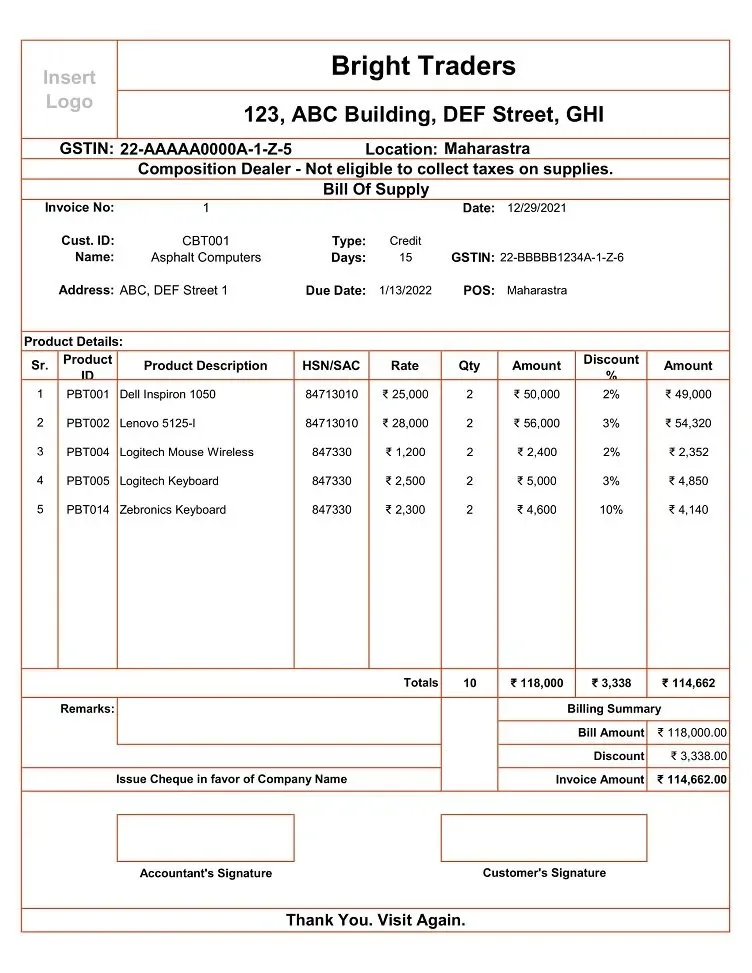

Bill of supply

According to the GST law, a bill of supply is a record for all non-taxable or exempt transactions. It is also issued by the taxable composition people. The absence of tax statistics makes it distinct from a typical tax invoice.

In either of these scenarios, the GST-registered party is unable to invoice and collect GST from the customer, hence no tax is shown on the invoice.

Refund

The document that the supplier gives to a person from whom he has received an advance when the contract or transaction is later cancelled is known as a refund voucher. It is required by the GST law, along with other records like the payment and receipt vouchers.

Since there won't be a tax invoice created in these situations, it serves as confirmation of the refund of the advance payment that was received.

Delivery note

Any time a shipment of products is delivered to a customer or buyer, a delivery note or delivery challan is the paperwork that is generated. It provides the list and quantity of the delivered products as well as the confirmation that the goods have been delivered to the buyer's location.

The individual delivering the package should mark any damaged items on the delivery note under the customer's name. Later, the vendor issues a credit note. According to the GST law, the seller often prepares three copies of the delivery note: one for his records, one for the carrier, and one for the consumer. In contrast, only two are typically raised, one for the client and the other for the records.

Other common names for it include dispatch notes or goods receipt notes. Regarding the issuance of delivery notes and their ramifications, there are certain requirements outlined in the GST law.

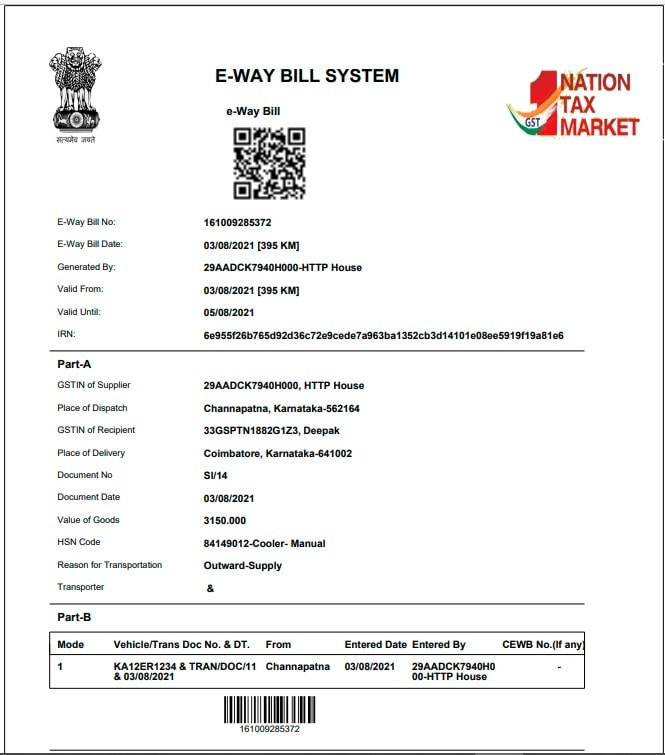

e-Way bill

Transporters are required by the GST law to carry an e-way bill while transferring products from one location to another, provided that certain requirements are met. An e-way bill is an electronic waybill created on the government's e-way bill portal by specific GST-registered vendors, any transporter, or any buyer, whether or not they are registered under GST.

Without a valid e-way bill, a registered person is not permitted to transport goods in a conveyance with a consignment valued at more than Rs. 50,000 (either on a single invoice or delivery challan). When an e-way bill gets generated, a unique E-way Bill Number (EBN) is allocated and accessible by the provider, recipient, and transporter.